Social trading is a form of trading that is becoming extremely popular and for many good reasons. At its basic level, social trading lets investors copy the strategies of experienced traders, making it easier for them to start investing. In a way, it’s just like sitting in a big trading room with your friend traders, but you can do it from your home, and without doing that much.

So, how does social trading work? This guide will cover how to get started, choose platforms, and manage risks, giving you the essentials to succeed.

Understanding Social Trading

Social trading is an online trading approach that allows investors to replicate the trades of experienced traders and regularly communicate with other traders who are part of a social platform. It leverages a community of traders who share insights, strategies, and real-time trade information to help each other succeed. This trading method breaks down barriers for new traders by providing a platform where they can learn from the pros, making it easier to start trading without extensive prior knowledge. Additionally, social trading networks enhance this experience by connecting traders in a collaborative environment where they can explore various social trading strategies.

This technique of observing and copying trades from an experienced trader, which is often used in prop trading firms, allows users to enhance their trading outcomes and gain valuable experience.

Social Trading vs. Copy Trading

If you are exploring the option of joining a social trading platform, you are likely to hear the term copy trading. So, what exactly is the difference between the two?

While social trading and copy trading are often used interchangeably, they have distinct differences. Social trading involves a broader community engagement where traders share market insights and strategies, fostering a collaborative environment. Often, it looks like a social platform where you can read news, see charts, and contact other members.

On the other hand, copy trading, as the name implies, focuses on directly replicating the trades of experienced traders automatically. This automation allows for hands-off trading, where a single trader’s actions are mirrored exactly in another account.

Take note that both methods enable less experienced traders to benefit from the expertise of successful traders, but social trading offers a richer, more interactive experience.

Here, at Switch Markets, we offer traders the opportunity to join a social network and copy trades of other successful traders.

Mechanisms of Social Trading

The mechanisms of social trading are fascinating and user-friendly. By connecting novice investors with experienced traders, social trading platforms enable real-time observation and replication of trading activities. Features such as portfolio mirroring and mirror trading are typically offered, allowing a trader’s entire strategy to be duplicated.

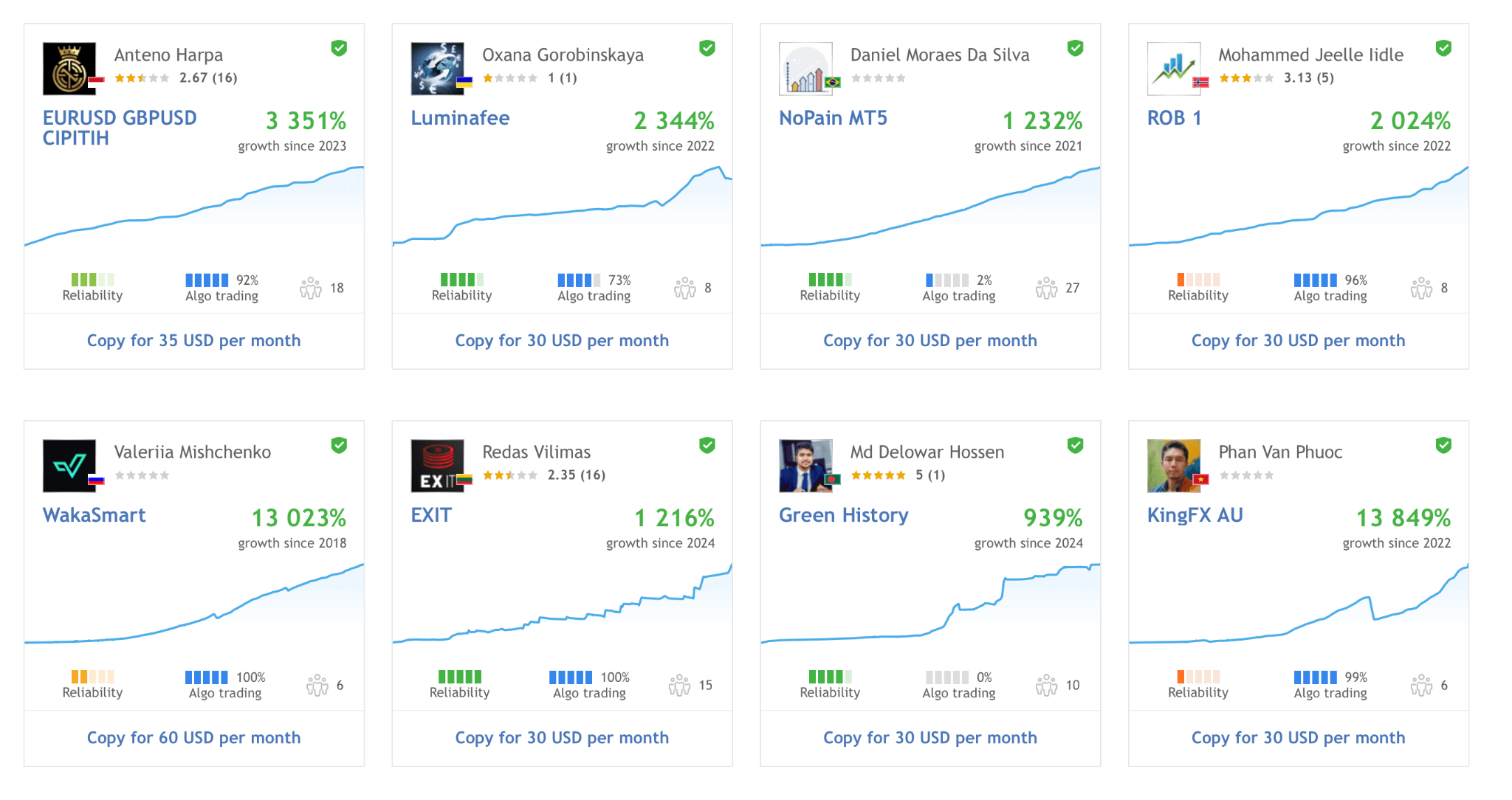

As you can see in the image below, this is what copy trading platforms look like. You have the option to choose a trader to follow based on the trader's portfolio's return, reliability, the markets traded by the followed trader, the type of execution (algo or manual), and the reviews.

This gives users the flexibility to choose how much of a trader’s trading strategy they wish to copy, from specific trades to the entire portfolio. This approach ensures that traders maintain control over their investment decisions while benefiting from the expertise of others.

How Social Trading Platforms Operate

In essence, social trading platforms are designed to facilitate community interaction and allow users to mirror the entire trading strategies of other successful traders. These platforms provide a user-friendly interface that displays the historical performance of various traders, enabling users to make informed decisions about whom to follow. Features like automated trading applications further enhance the trading experience by optimizing strategies with algorithmic capabilities. With that in mind, if you wish to copy an automated strategy, we highly recommend adding a VPS to your trading platform. Visit this page to learn more about our free VPS service.

Moreover, you should also be aware that these platforms often include community forums and social networks where traders can share knowledge and interact with one another. This communal aspect is crucial, as it allows traders to exchange ideas, learn from each other, and build a supportive trading community.

Role of Trading Signals

Another key advantage of a social trading platform is the use of trading signals, which play a pivotal role in social trading by providing actionable buy and sell suggestions based on comprehensive analysis. These signals can be generated through technical analysis, fundamental analysis, or a combination of both, offering traders valuable insights into market trends and opportunities. Whether derived from historical data or real-time market conditions, trading signals help traders make informed decisions and execute trades more effectively.

Now, with the advent of AI-driven technologies as well as AI trading bots, the accuracy and reliability of trading signals have significantly improved. These technologies process vast amounts of data to identify patterns and predict market movements, providing traders with precise buy and sell suggestions. Having said that, we highly recommend that before applying trading signals in a live account, you should first backtest them on a demo account.

Getting Started with Social Trading

Beginning with Switch Markets’ social trading application is a straightforward and easy process. Here’s how you can get started:

- The first step is to open an account with Switch Markets and fund your account. Note that Switch Markets offers 14 payment methods, including the possibility of funding your account using Bitcoin and other cryptocurrencies.

- Once your account is approved and the funds have been transferred, you can navigate to the MQL5.com community and register as a member.

- Connect your MQL5 account to your chosen trading platform. For a detailed instruction on how to do that, you can visit our guide on how to connect your MQL5 account to MT4/5.

- Choose a strategy and start copying other successful traders.

- Regularly monitor your trading account, track your trades using our built-in application, TrackATrader, and make the necessary adjustments.

Take note that you can also add other features to your account, including trading signals, Expert Advisors tools, news plugins, and many more. Furthermore, you can join the MQL5 forum and engage with other traders.

Benefits of Social Trading

The benefits of social trading are numerous and impactful. One of the primary advantages is the simplicity of starting your trading journey. All you have to do is to open an account and choose a trading strategy you’d like to copy. You can then monitor your account on a daily basis and decide whether you wish to continue with the same strategy or switch to another that might be more suitable for your trading preferences.

Social trading also reduces the need for extensive market research, saving time for traders in their decision-making process.

What’s more, less experienced traders can improve their extensive market knowledge and skills by following and replicating the strategies of seasoned traders. Additionally, the collaborative environment of social trading platforms provides diverse market insights and support, enhancing the overall trading experience.

Lastly, social trading is a fun way to trade the markets. You are not alone; if you have a problem or you need advice, you can contact other members to get the support you need. You can also contact other traders to get an idea of the market sentiment or where they predict the specific market might be heading.

Risks and Challenges in Social Trading

Social trading has numerous advantages. However, it also presents certain risks and challenges. One significant risk is the potential for financial losses in volatile financial markets. Even with sound strategies, traders can incur losses, highlighting the importance of not relying solely on others’ methods.

Replicating both the successes and failures of the traders you follow can lead to significant financial setbacks. After all, you completely rely on other traders’ decisions.

Therefore, due diligence is crucial for understanding your investment choices and managing risks effectively. It is also highly recommended that you backtest the strategy you wish to copy on a demo account before you apply it in live markets.

Summary

In summary, social and copy trading offer a unique and accessible way for investors to engage in financial markets. By replicating the trades of experienced traders, you can learn valuable strategies and potentially achieve higher returns. Not only that, social trading platforms also facilitate community interaction, providing support and shared insights that enhance the overall trading experience.

While there are risks involved, effective risk management strategies can help mitigate these challenges. At the end of the day, it’s a trial-and-error process. The ideal method is to set a budget until you find the best trader to copy or the best trading signal provider.

Either way, embracing advanced tools and technologies, such as AI and automated trading applications, can help you to further optimize your trading outcomes.

For more information regarding our social trading platform, you can visit this page or contact our support team.

Frequently Asked Questions

Here are some of the most common questions regarding social trading:

What is social trading?

Social trading is a form of trading that lets you watch and replicate the trades of other investors, making it easier to learn and potentially profit. Additionally, it’s a social platform where you can engage with other traders and find valuable information about the markets, the specific asset you are trading, your trading platform, and more.

What is a key risk when copying trades from signal providers?

A key risk of copying trades from signal providers is blindly following their moves without grasping their strategy, which can easily result in major losses. As such, always be sure to understand what you're getting into, and before applying a strategy with real capital, backtest a strategy on a demo account.

What is the purpose of the MQL5 Programs Market?

The MQL5 Programs Market is all about helping you automate your trading with a huge selection of over 10,000 apps and new tools popping up daily. Whether you wish to copy trades of other successful traders, become a copy trading trader, purchase successful EAs, or engage with other traders, the MQL5 market can help you achieve your goals.