Pivot Point Calculator

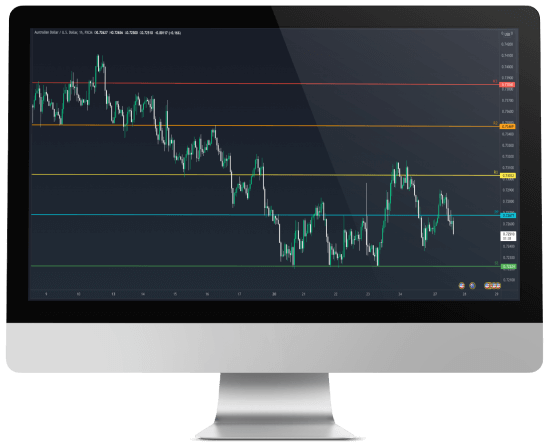

Want to easily identify significant daily, weekly, and monthly support and resistance price levels on your chart? Use our advanced Pivot Point calculator and let us do the calculations for you.

What are Pivot Points?

Pivot points are a technical analysis indicator used by traders to determine potential support and resistance levels and how prices could potentially turn. They are calculated based on the previous day’s low, high, and closing prices. Traders use pivot points and the support and resistance levels they provide to identify potential entry or exit points, and stop-loss prices for their trades.

How to calculate Pivot Points?

To use the Pivot Point Calculator, please enter the previous day high price, previous day low price, previous day open price and previous day close price. Once you've entered the previous period's data, please click 'Calculate' and the Pivot points calculator will determine the pivot point levels (or pivot point price) for you.

How Does The Pivot Point Calculator Work?

There are different types of pivot point calculation methods. To calculate either of these, the following variables are required: previous high price (H), previous low price (L) , previous open price (O) and previous close price (C). Some formulas also require Resistances levels (R) and Support levels (S).

Standard (Floor)

The floor Pivot Points, also known as Standard Pivots and are the most basic type of pivot points used in Forex. They are price-based support & resistance levels and can be calculated using a previous period's low, high, and closing prices. The following Floor pivot point formulas are used to calculate the values:

PP = (H + L + C) / 3

R1 = (2 x PP) - L

S1 = (2 x PP) - H

R2 = PP + (R1 - S1)

S2 = PP - (R1 - S1)

R3 = H + 2 x (PP - L)

S3 = L - 2 x (H - PP)

Woodie

Woodie's Pivot Points are a special type of pivot points made up of various key levels. They are calculated using previous price point values. The following Woodie pivot point formulas are used to calculate the values

PP = (H + L + (2 x C)) / 4

R1 = (2 x PP) - L

S1 = (2 x PP) - H

R2 = PP + H - L

S2 = P - H + L

Camarilla

Camarilla pivot points are a set of eight very probable levels which resemble support and resistance values for a current trend. The following Camarilla pivot point formulas are used to calculate pivot point levels:

PP = (H + L + C) / 3

R1 = C + ((H -L x 1.1/12)

S1 = C - ((H -L) x 1.1/12)

R2 = C + ((H - L) x 1.1/6)

S2 = C - ((H - L) x 1.1/6)

R3 = C + ((H - L) x 1.1/4)

S3 = C - ((H - L) x 1.1/4)

R4 = C + ((H - L) x 1.1/2)

S4 = C - ((H - L) x 1.1/2)

Tom DeMark's

Tom DeMark's pivot points are the predicted lows and highs of the period. They can be calculated using the following formula:

If Close < Open: X = H + (2 x L) + C

If Close > Open: X = (2 x H) + L + C

If Close = Open: X = H + L + (2 x C)

R1 = X / 2 - L

S1 = X / 2 - H

Fibonacci

Fibonacci pivot points are one of the most popular types of forex indicators used to find the support and resistance levels. The following Fibonacci formulas are used to calculate the values:

PP = (H + L + C) / 3

R1 = PP + ((H - L) x 0.382)

S1 = PP - ((H - L) x 0.382)

R2 = PP + ((H - L) x 0.618)

S2 = PP - ((H - L) x 0.618)

R3 = PP + ((H - L) x 1.000)

S3 = PP - ((H - L) x 1.000)

Why use the Pivot Point Calculator?

Due to its predictive qualities, Pivot Points are considered to be one of the leading indicators on the market. With our advanced calculator, you can skip the maths and jump straight into the fun part and trade pivot points!

Hassle-free

It takes just a few moments to fill out the calculator fields. Our Pivot Point calculator will do the rest for you.

Reliable

Our Pivot Point indicator is trusted by thousands of traders worldwide.

Integrated

Works well with different types of pivot point calculation methods.

Flexible

No matter what you want to calculate and what pivot point system you use, we've got you covered.

Let The Tools Do The Hard Work For You

We all know that the markets can be challenging. That’s why we aim to provide traders with any help they may need to improve their chances of potential success. And the best part? It’s free!

Forex Profit Calculator

Calculate your profits and losses before or after executing a trade with our free Forex Profit Calculator.

Forex Lot Size Calculator

Use our simple yet powerful Forex Lot Size Calculator to calculate the exact position size for each trade and manage your risk per trade like a pro.

Forex Economic Calendar

Access our free economic calendar and explore key global events on the horizon that could subtly shift or substantially shake up the financial markets.

Currency Strength Meter

Compare the performance of major currencies relative to others in real-time with our advanced Currency Strength Meter.

Market Heat Map

Measure the strength of major currencies relative to others in real-time and quickly and easily determine when a currency is moving strongly in one direction or another.

CAGR Calculator

Calculate the Compound Annual Growth Rate (CAGR) of your investments with our easy-to-use CAGR Calculator.

Value At Risk Calculator

Calculate how much of your investment you might lose at given normal market conditions, over a given period based on the probability of past performance.

Pip Calculator

Calculate the pip value of your trades for all major Forex currency pairs, indices, cryptocurrencies, and more, using live market quotes.

Forex Swap Calculator

Calculate the swap fee you will be charged on your trading account for holding your positions overnight with ease.

Forex Margin Calculator

Determine the exact margin you need to open a trading position with our easy-to-use Forex margin calculator.

Forex Compound Calculator

Use our advanced Forex compound calculator and simulate the profits you might earn on your Forex trading account.

Pivot Point Calculator

Use the pivot point calculator to calculate pivot points and determine potential support and resistance levels and how prices could potentially turn.

Tight spreads that make a difference.

Diverse liquidity providers ensure our spreads are tight around

the clock. Trade with spreads as low as 0.0* pips.

Start trading in minutes

Demo environment