Social Trading

Like most beginner traders, you are probably intrigued by the idea of trading signals. Learn more about how Social Trading works and if it's right for you.

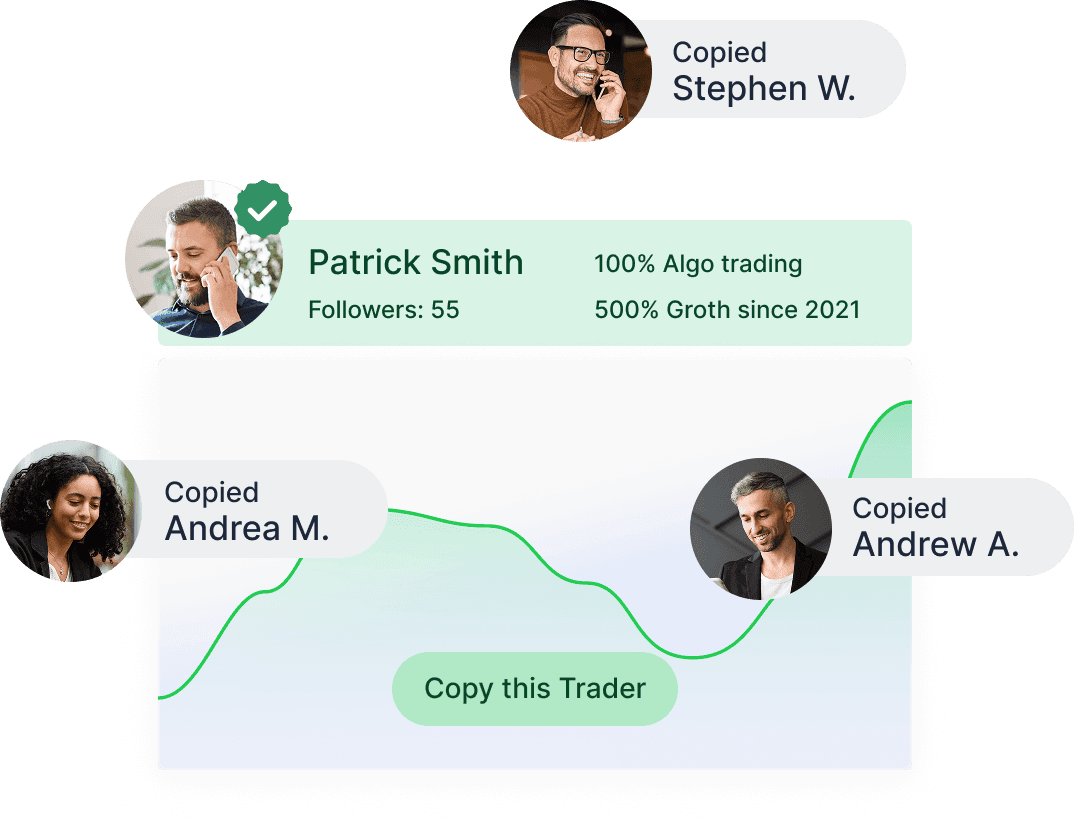

What is Social Trading?

Social trading is a form of trading that enables traders and investors to observe and copy someone else's trades. Typically, new or intermediate traders are interested in social trading as it offers a way to reduce the amount of time the individual spends placing their own trades. Social trading is not suitable for everyone so do your own research.

Is social trading suitable for traders like me?

Answer these questions to see if you're a good fit to try social trading. Remember to count your Yes's.

Are you tired of doubts and excessive trading emotions?

How can you start social trading?

Open a live Account at Switch Markets

Fund your live trading account

Register at MQL5.com community

Choose the Strategy Providers and start copying!

Social trading made easy. Find out how we can help you!

MetaTrader Trading Signals is a copy-trading solution that allows traders to copy the most successful strategies from thousands of traders from all over the world! Lean on other traders skills and experience to boost the performance of your own trading.

Why trade with Switch Markets?

0% commission & no hidden costs

Whatever you're trading, we know that every penny matters. That's why we're all about low spreads and transparent pricing.

Fast order execution

Average execution speeds of under 76ms. Do we need to say anything else?

Spreads from 0.0 pips

Spreads with no hidden costs mean we really do offer 0.0 pips. Switch Markets is the difference traders have been waiting for.

1:30 Maximum Leverage

Spread the costs and trade with leverage up to 1:30 on hundreds of global markets including Forex, Stocks, Commodities & more.

Free Forex VPS

Real traders know that using a VPS makes all the difference. We are now giving out a free Forex VPS with every new account!

Trade 1,000's of Global Markets

Global markets right at your fingertips...

Forex

Majors, minors and exotics. No matter the pair, we've got you covered.

Indices

Trade indices from across the globe and major markets.

Digital Currencies

Trade the most widely used digital currencies.

Commodities

Gain access to energy, agriculture and metal markets - we've got it all!

CFD Shares

Buy and Sell 1,000's of Stocks of the most popular companies.

Frequently Asked Questions

Read our frequently asked questions below. If you still need help, contact us today.

How do I start trading with your broker?

How long does the demo account with your broker last?

What costs are involved in trading with Switch Markets?

How fast are withdrawals at your broker?

Why would a trader need a VPS for trading?

Is it complicated to set up and use a VPS for trading?

Can I access my broker trading account from anywhere using a VPS?

How does a trading VPS simplify trading from multiple devices or locations?

Do you offer a demo account at your broker?

What is the minimum amount needed to open a Switch Markets trading account?

Do I get charged for a dormant trading account?

How does a VPS improve trading performance?

How do I contact support?