In trading, traders only have two decisions in the market: to buy or to sell. But there are a lot of ways to go about this, and that’s where trading orders come in.

Trading orders are essential tools that allow traders to buy and sell assets at specific prices or conditions, often at a certain price, to manage risk effectively.

Below, we’ll break down the seven most popular order types, their use cases, and examples.

What is a Trading Order?

A trading order is an instruction given to a broker or trading platform to buy or sell a financial instrument at a specified price or under certain conditions.

These unique orders allow traders to control how and when they enter or exit a trade, often based on the current price of the financial instrument.

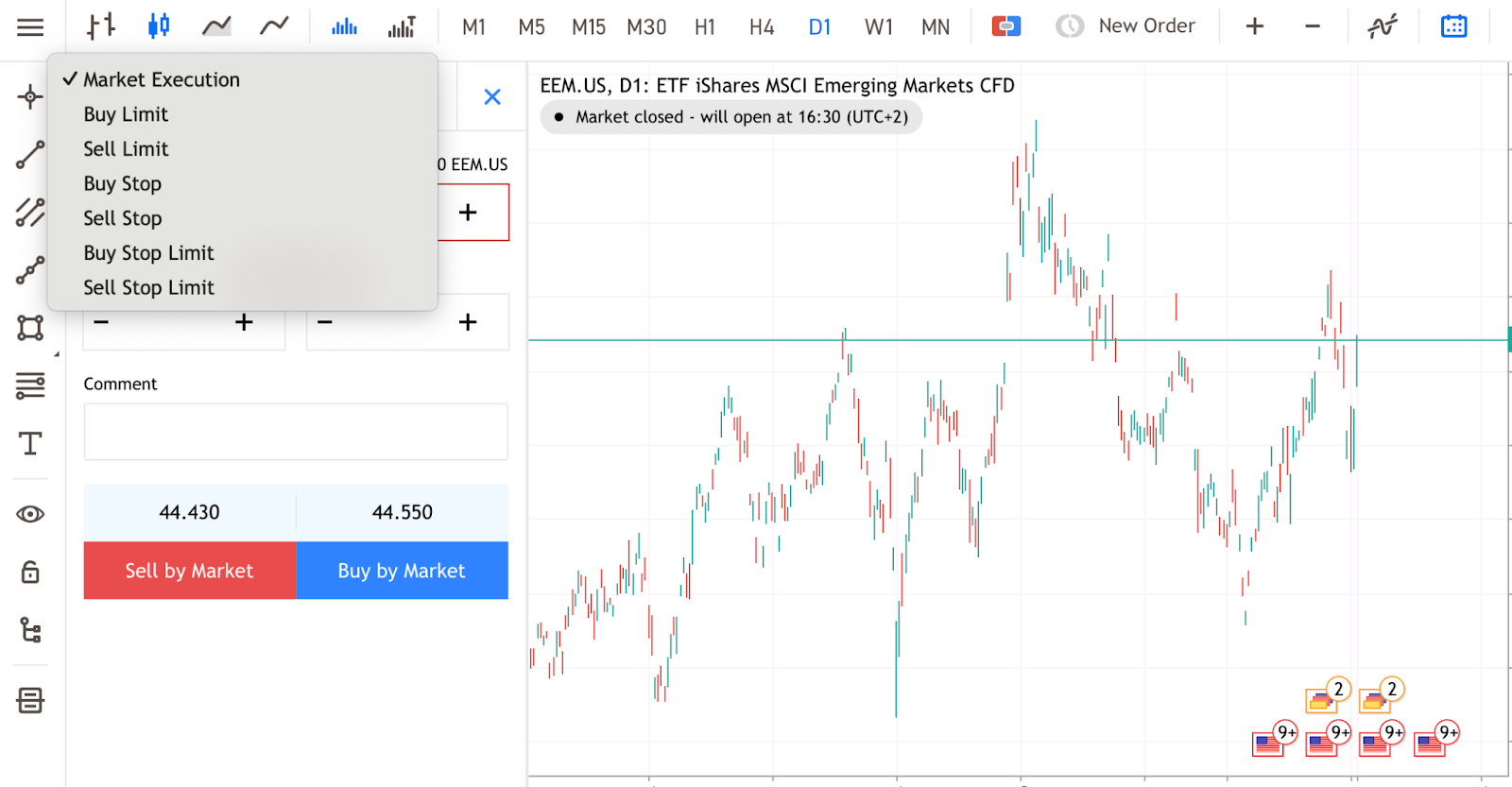

Crucially, every brokerage firm enables traders to make a variety of trading orders. At Switch Markets, for example, traders get the following order types: market orders, buy limit, sell limit, buy stop, sell stop, buy stop limit, and sell stop limit.

Each order has its own purpose, which is critical for traders to understand in order to manage their risk and take advantage of the different order type mechanisms.

7 Most Popular Order Types Available to Traders Explained

As mentioned above, each order type serves a specific purpose, whether it’s executing immediately, setting a price limit, or protecting against losses.

The right order type depends on your strategy, market conditions, and risk tolerance.

With that in mind, let’s look at the 7 most popular order types presented on our MT4/MT5 trading platforms:

Market Execution

The first order type is probably the easiest to pull off. A market order executes immediately at the best available stock price.

Traders usually use this type of order by simply hitting the buy or sell button on their trading platform when all their entry criteria are met. This type of order is useful when traders prioritize speed over price precision, and such, it is often used by scalpers and short-term day traders.

Example:

Let's say you want to buy EUR/USD at the current market price of 1.08396. You can simply place a market order by clicking the "Buy" button at the top left corner of your screen, and the trade is executed instantly at the best available price.

However, if the price moves rapidly, the final execution price may be slightly different from the expected price. This is known as a Price Slippage, and the best way to avoid slippages is by using a VPS, which is given for free to all Switch Markets clients.

Best For: Traders who need immediate execution, regardless of minor price fluctuations.

Risk: Market orders can result in slippage if prices change rapidly between placing and executing the order.

Buy Limit

A buy limit order is a type of order that allows you to set a price below the current market price. The order will only be executed if the price falls to the specified level.

Example:

Let's say GBP/JPY is trading at 192.307, but you believe it will dip to 191.425 before rising again.

You place a buy limit order at 191.425. If the price drops to the specified limit price of 191.425 or lower, the order executes automatically. If the price never reaches 191.425, the order remains unfilled.

Best For: Traders looking to buy at a discount or ‘buy the dip’ without constantly watching the market.

Risk: If the price never drops to the limit level, the order is not executed, potentially missing the trade opportunity.

Sell Limit

A sell limit order allows traders to set a price above the current market price. The order is only executed if the price reaches or exceeds the specified level.

Example:

In the chart above, you can see USTECH (Nasdaq 100) currently trading at 19435.8. However, by using the Fibonacci Retracement tool, you are anticipating a further pullback to the 70% level. That means you want to sell only if the price rises to 19472.8.

You place a sell limit order at 19472.8. If the price reaches the trigger price of 19472.8, the order executes automatically. If the price never reaches 19472.8, the order remains unfilled.

Best For: Traders who want to sell at a higher price than the current market price.

Risk: The price may never reach the limit level, and you might miss an opportunity to sell if the market reverses.

Buy Stop

A buy-stop order is placed above the current price and triggers a market order once that price is reached. It is commonly used in breakout trading strategies.

Example:

For example, AUD/USD is trading at 0.63043, but you believe that if it surpasses 0.63085, it will continue rising.

You place a buy-stop order at 0.63085. If the price reaches 0.63085, the order executes at the next available price.

Best For: Traders who want to enter a trade only if upward momentum is confirmed.

Risk: The price may hit the stop level and then reverse, leading to a loss.

Sell Stop

Sell stop orders are placed below the current market price and are used to trigger a market order once the price falls to a certain level. These orders are commonly used for risk management, although it is also often used in falling markets.

Example:

Looking at the USD/CNH, let's say you see a double bottom, but you are expecting the price to sell massively after a breakout from that region; one way to go about it is to set a SELL stop order just below the current market price, as shown in the chart above.

Best For:

- Limiting losses by selling before a bigger price drop, especially while trading futures.

- Entering short trades during downtrends.

Risk: The price could briefly hit the stop level before reversing, leading to an unnecessary sale.

Buy Stop Limit

A buy stop limit order combines a buy stop order and a limit order. Once the stop price is reached, a buy limit order is placed instead of a market order.

Example:

So, let’s say USD/CHF is trading at 0.88448. You want to buy if the price breaks above 0.88840, but you don’t want to enter at a price higher than 0.88660. In that case, all you need to do is simply place a buy-stop limit order with a stop price at 0.88840 and a specified limit price at 0.88660.

If the price reaches 0.88840, a limit order is placed at 0.88660. The trade will only open if the price gets to the limit price or lower.

Best For: Traders who want to buy on a breakout but still control their entry price.

Risk: If the price moves too quickly, the limit order may not be filled, and the trade is missed.

Sell Stop Limit

A sell stop limit order combines a sell stop order and a limit order. Once the stop price is reached, a sell limit order is placed instead of a market order at a certain price.

Example:

Let's say you want to place a Sell Stop Limit order for EURAUD. You set your Stop Price at 1.71041, meaning the order will only activate when the price falls to this level. However, instead of selling immediately at market price, you also set a Sell Limit at 1.71734, ensuring the order executes only if the price retraces back up to this level.

Once the price drops to 1.71041, your order is triggered, and a Sell Limit order is automatically placed at 1.71734. If the market pulls back and reaches this limit price, your sell order is executed, giving you a better entry for your short trade. However, if the price continues falling without retracing, the sell order remains unfilled, preventing you from selling at an unfavorable lower price.

Best For: Traders who anticipate a breakdown followed by a pullback before further decline.

Risk: If the price never retraces to the limit price, the sell order remains unexecuted, potentially missing the trade.

Wrap It Up - Key Takeaways

We know these order types can be a lot to commit to memory at a time. So, here's a quick takeaway:

Understanding these order types empowers you to execute your trades more effectively, minimize risk, and optimize profits. To get the best results, we suggest you test the different trading order types on a demonstration account before you test those on the live market.