You place a trade at $100. A second later, you check your actual execution price—$100.50, which is different from the actual price you anticipated.

Wait… what?

You didn’t agree to that price. But your broker executed the order there anyway. What just happened? Slippage.

Price slippage is one of those things traders don’t think about—until it starts eating into their profits. And here’s the kicker: it happens to everyone. Day traders, swing traders, algo traders, and even massive hedge funds.

If you don’t understand how slippage works, you’re basically handing the market free money without realizing it. And if you think it’s “just a few cents,” think again—over time, those extra costs stack up fast.

So, what’s the game plan? Simple: learn how slippage works, know when it happens, and figure out how to minimize it.

What Is Price Slippage In Trading?

So, what exactly is a price slippage?

Simply put, slippage happens when your trade gets executed at a price different from the intended price.

For instance, you place a buy market order at $100, but by the time it fills, the price is $100.30. Or your stop-loss at $95 gets triggered at $94.20 instead.

It’s frustrating, right?

But here’s the thing: prices move fast, and if there’s not enough liquidity at your requested price, your order gets filled at the next available one. It's all about timing and your broker's ability to provide fast order execution.

And it doesn’t just happen to small traders—it happens to everyone. From solo traders with a $500 account to billion-dollar hedge funds placing million-dollar orders.

In trading, slippage occurs when a trader’s order is executed at a price different from what was originally intended. For instance, you place a buy market order at $100, but by the time it fills, the price is $100.30.

Why Should You Care?

Because slippage can eat into your profits before you even realize it.

- If you’re a scalper or day trader, slippage can be the difference between a winning and losing trade.

- If you’re a swing trader, it can mess up your risk-to-reward ratio.

- And if you’re trading big positions, even a tiny bit of slippage can mean thousands of dollars in unexpected losses.

Slippage isn’t always bad, though. The price difference between the intended and actual execution price can lead to either positive or negative slippage, affecting your trading outcomes. Sometimes, you’ll get positive slippage, where your order executes at a better price than expected. But let’s be honest—traders don’t usually complain when that happens.

The real problem is negative slippage—when the market moves against you before your trade is even placed. And that’s what we need to control.

So, what causes slippage? And more importantly, how do you stop it from wrecking your trades?

Let’s break it down.

Types of Slippage In Trading

Not all slippage is created equal. Slippage can occur in various financial markets and in different types of orders. It sneaks into your trades in different ways. So, let’s break down the main types of price slippage:

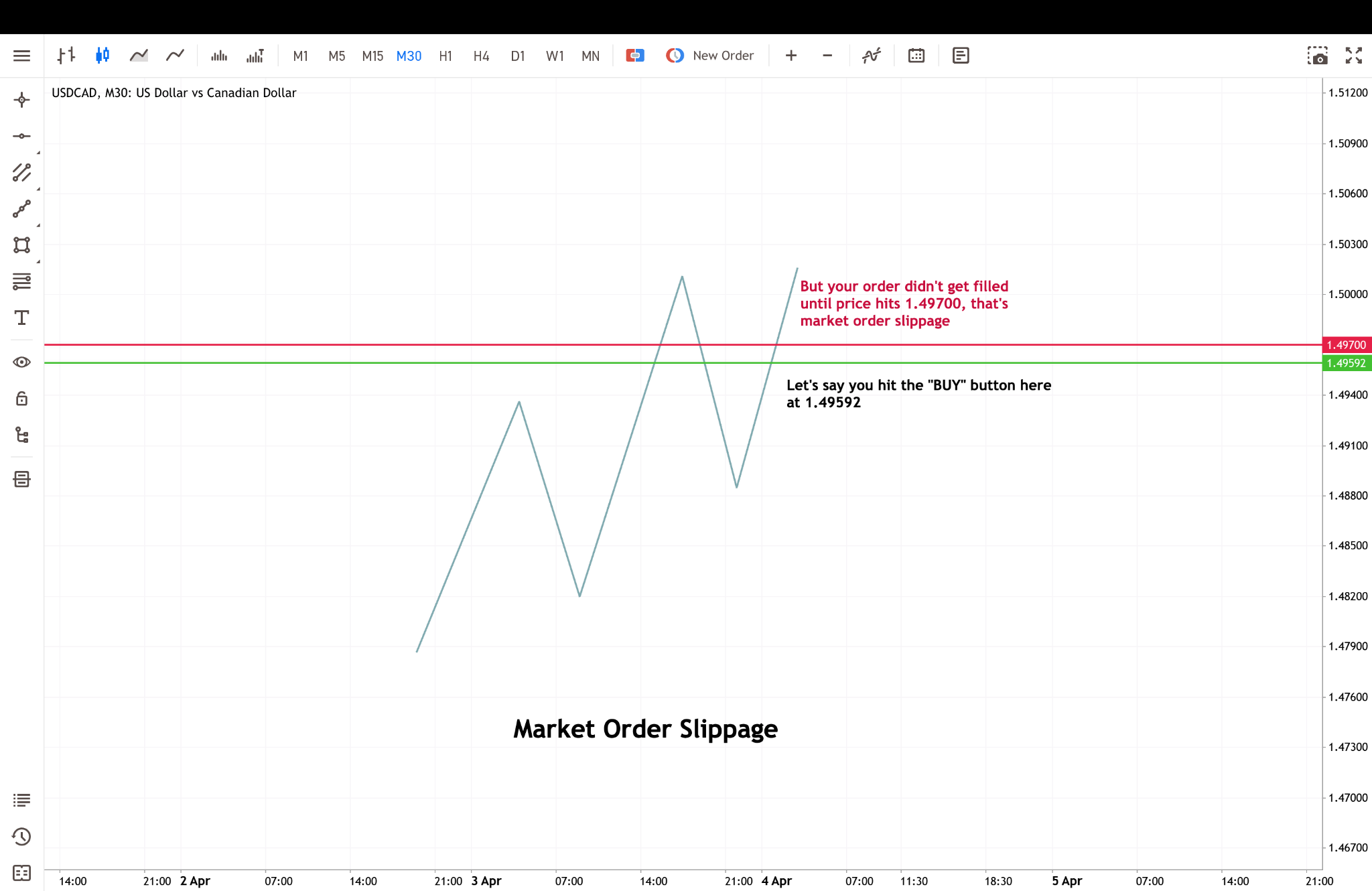

1. Market Order Slippage

When you hit “buy” or “sell” at the market price and end up with a worse price than expected? That’s market order slippage.

Since market orders execute at the best available price, if liquidity is low or volatility is high, your order might fill at a less favorable price than what you saw on your screen.

Let’s say you try to buy at USD/CAD at 1.49592 (as shown in the example above), but by the time your order gets filled, the price has jumped to 1.49700. That’s a 1.05-pip slippage (0.00108 difference), and if you’re trading big size, that adds up fast.

How to Avoid It? Use limit orders, which execute only at a specified price or better, instead of market orders (more on this later). Another way to reduce slippage is by using a VPS, which is provided for free to all Switch Markets clients.

Open an Account and Get a VPS For Free

2. Stop-Loss Slippage

Slippage can also happen when you place a stop loss order., When the market moves too fast, your stop-loss might not get filled at the exact price you set—it could slip past it, leaving you with a different price than intended.

For instance, if you set a stop-loss at 1.41600 on a USD/CAD trade, but a sudden price increase causes your order to execute at 1.41660 instead.

Why does this happen? Because stop-loss orders turn into market orders when triggered, and if there’s no liquidity at your price, the order fills at the next available one. It can also occur in volatile markets, where prices can spike without hitting all levels. A good solution can be to use a guaranteed stop loss order and utilize our risk management EA. And, of course, use a VPS that significantly reduces slippage.

3. Limit Order Slippage

Wait—Limit orders can cause slippage, too? Yep, but in a different way.

With a limit order, you essentially tell the market, "Fill my order at this price or better." That means you won’t suffer negative slippage, but here’s the catch:

If the price never reaches your limit, your order won’t get filled at all.

As you can see in the chart above, if you place a sell limit order at 0.90015, but the price only climbs to 0.89840 before dropping, your order never executes, and you miss the move entirely. This is a limit order slippage.

When Does Slippage Occur?

Slippage doesn’t just happen randomly—it follows patterns. If you know when it’s most likely to happen, you can adjust your trading to reduce its impact. Here are the key moments when slippage is at its worst.

Market Volatility

The market moves fast, but sometimes it explodes with activity. During periods of heightened volatility, such as significant news events, prices can change in the blink of an eye, making it harder for your orders to fill at the price you want.

This can happen during market opens and closes when traders rush in and out, or after unexpected news drops, or major economic reports. For that reason, it is always important to follow the economic calendar and know ahead of time what data is expected to be released.

Liquidity Issues

Slippage also happens when there aren’t enough buyers or sellers at your chosen price. In other words, when there's no liquidity in the market.

If you place a large order in a thinly traded market, there might not be enough liquidity to fill it at a single price, causing portions of your order to execute at different price levels.

When does this happen?

- In after-hours or pre-market trading

- On exotic forex pairs, illiquid stocks/ETFs, commodities/indices/cryptos

- When trading large positions

Order Execution Speed

In trading, milliseconds matter. If your broker or trading platform executes orders too slowly, slippage becomes unavoidable.

By the time your order gets processed, the market may have already moved, leaving you with a worse fill than expected.

Factors that slow execution speed:

- Slow internet connection

- Using a broker with poor execution speeds

- Trading from a laggy platform

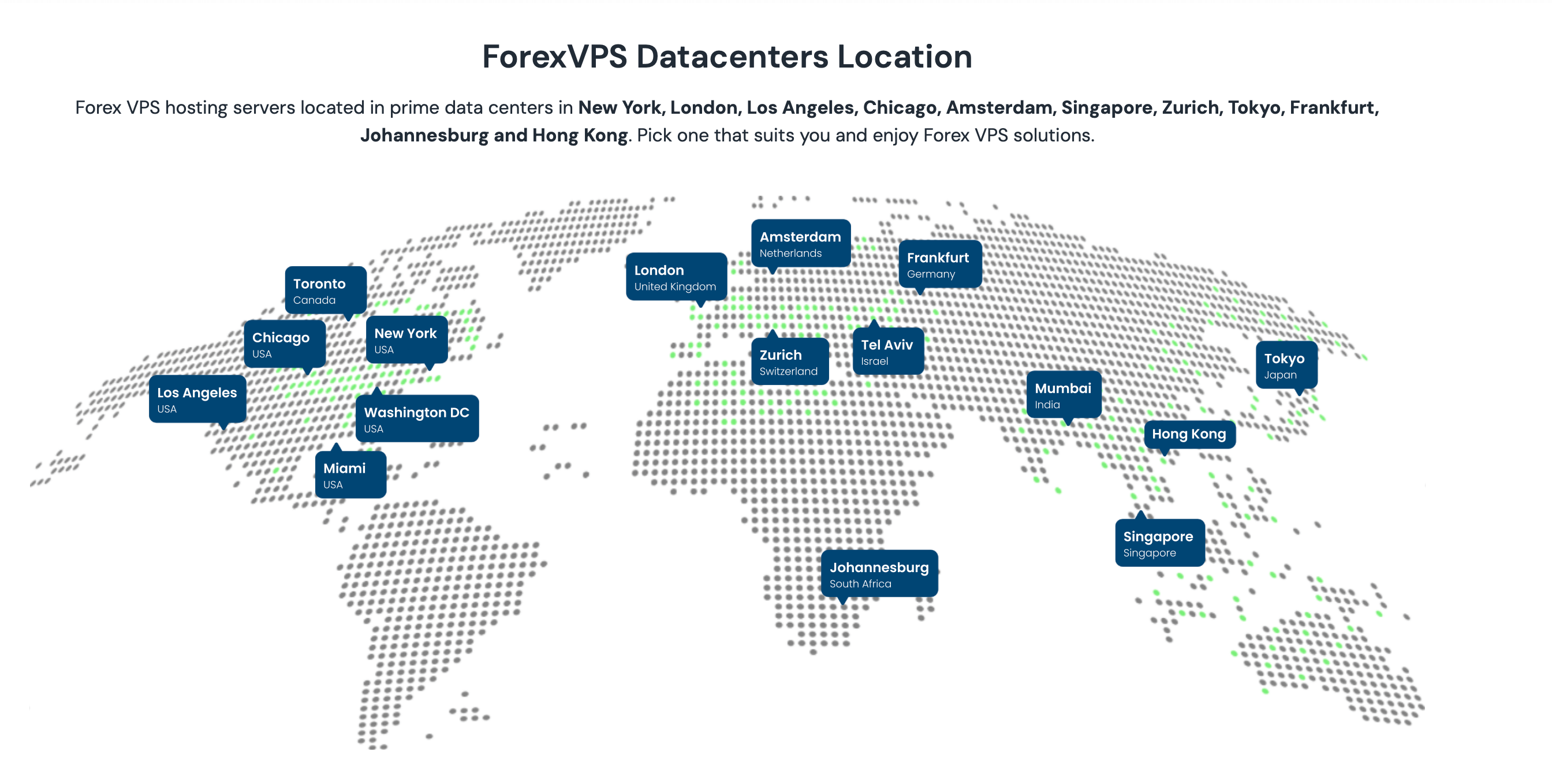

Keep in mind that your order execution speed is dependent on the proximity of your servers to the broker's server or the exchange server. This is why a VPS is such a valuable tool, as it enables you to use virtual servers that are located in prime centres close to your broker or the exchange. For example, Switch Markets clients get a free account on ForexVPS, one of the leading trading VPS services in the market, which has hosting servers located in 24 prime data centers worldwide.

High-Impact News Events

The market loves surprises, and nothing moves prices faster than unexpected news. When a major event drops, sudden price movements can cause prices to gap past your stop-loss or entry point, causing extreme slippage.

Common culprits:

- Economic data releases like the Non-Farm Payrolls, inflation reports, and GDP data.

- Interest rate decisions such as the Federal Reserve, ECB, and BOE rate hikes or cuts.

- Breaking geopolitical news around war, sanctions, and policy changes.

- Company earnings reports.

Price Slippage vs. Spread

Many traders confuse slippage and spread, but they’re not the same thing. Understanding the difference can help you make better trading decisions and avoid unnecessary losses.

What Is the Spread?

The spread is the difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are offering).

Think of it like this:

- You go to a currency exchange and see two prices for EUR/USD: 1.2000 (buy) / 1.1998 (sell).

- The spread here is 2 pips (1.2000 - 1.1998).

- Every time you enter a trade, you start at a small loss because you buy at a higher price than you can immediately sell for.

Here's what a spread looks like:

Key takeaway: The spread is a built-in trading cost—it’s not slippage.

What Is Slippage?

Slippage happens when your actual trade execution price is different from the price you expected.

Example:

- You place a market buy order at $100.00.

- Due to fast price movement, your order gets filled at $100.50.

- That $0.50 difference is slippage.

Slippage occurs because of market volatility, liquidity issues, and execution speed.

Key takeaway: Slippage is an uncontrollable price change during execution, while the spread is just the cost of entering/exiting a trade.

How They Affect Your Trades

Here are the key differences between spread and slippage:

How to Stop or Reduce Slippage in Trading

Slippage can’t be eliminated entirely—it’s part of the game. But just like a pro athlete learns to minimize injuries, traders can take steps to reduce slippage and keep more profits. Here’s how:

1. Use Limit Orders Instead of Market Orders

The fastest way to avoid slippage? Stop using market orders.

Market orders tell your broker, “Get me in or out at the best available price.” The problem? That price might not be what you expected.

Limit orders fix this. Instead of taking whatever price the market offers, a limit order only executes at your set price (or better).

Example:

- You want to buy Apple stock at $175.00.

- With a market order, you might get filled at $175.30.

- With a limit order at $175.00, your order won’t execute unless the price reaches that level.

2. Trade During High Liquidity Hours

Liquidity equals more buyers and sellers in the market. More liquidity means tighter bid-ask spreads and less chance of wild price jumps.

Best times to trade:

- For forex: The London and New York overlap (8 AM - 12 PM EST) has the highest volume.

- For stocks: The first 30 minutes after market open can be volatile, but midday trading (10:30 AM - 3 PM EST) usually has smoother price action. In stock markets, trading during high liquidity hours, such as the first 30 minutes after market open, can help limit risks such as slippage by ensuring quick execution of trades.

- For crypto: Liquidity depends on the coin, but weekdays generally have higher volume than weekends.

Avoid trading right at the market open or close, when spreads widen and price swings are unpredictable.

3. Avoid Trading Around High-Impact News

Big news events can cause slippage nightmares. If you don’t want to get caught in the chaos, check the economic calendar before placing trades.

How?

- If a major event is coming up (like an interest rate decision), wait until the announcement is over before entering a trade.

- If you’re already in a trade, consider tightening your stop-loss or reducing position size to protect against extreme moves.

4. Choose a Broker with Fast Execution and a VPS

Your broker’s execution speed matters. A slow broker can turn a small trade into a slippage disaster.

What to look for?

- ECN or STP brokers - they route your orders directly to the market, reducing delays. To learn more, visit our guide on ECN vs Standard account - Differences, and How to Choose.

- Low-latency trading servers

- A Virtual Private Server (VPS) if you’re trading algo or high-frequency strategies.

If slippage is eating into your trades, it might not be your strategy—it might be your broker, but more on this later.

How to Reduce Slippage in Algo Trading

Algorithmic trading comes with speed and precision, but it doesn’t mean slippage disappears. In fact, slippage can hit algo traders even harder if execution isn’t optimized. Here’s how to keep your trades running smoothly.

1. Optimize Order Routing

Not all brokers execute orders the same way. Some internalize orders (meaning they fill trades within their own system), while others route orders to the best available market price.

For algo traders, direct market access (DMA) or ECN execution is key to reducing slippage. Instead of letting a broker decide how to fill your order, DMA ensures it goes straight to the liquidity pool with the best price.

Solution? If you’re serious about execution, choose a broker like Switch Markets that offers direct market access and institutional-grade liquidity.

2. Adjust Slippage Tolerance Settings

Most algo trading platforms let you define a slippage tolerance—the max amount of price movement you’re willing to accept before an order gets rejected.

- If the setting is too tight, your orders might fail to execute.

- If it’s too loose, you might end up with worse fills than expected.

3. Use VWAP & TWAP Execution Strategies

Instead of sending one big order that can move the market, institutional traders and hedge funds use execution algorithms to break up orders into smaller pieces over time.

- VWAP (Volume-Weighted Average Price): Splits orders based on trading volume, ensuring a more natural execution that minimizes market impact.

- TWAP (Time-Weighted Average Price): Executes trades evenly over a set time period, preventing large orders from causing slippage.

If you’re trading large positions or illiquid assets, these strategies help control slippage without disrupting the market.

4. Trade During High-Liquidity Sessions

Even algo traders need to consider liquidity. If your bot executes during low-volume hours, you risk wide spreads and poor fills.

For best results, program your strategy to trade:

- During major market hours (London & New York sessions for forex, regular market hours for stocks).

- When spreads are tightest (midday trading usually has smoother price action).

- Away from high-impact news events.

5. Use a VPS for Faster Execution

If your trading bot is running on a home computer with an unstable internet connection, slippage is the least of your problems.

A Virtual Private Server (VPS) keeps your trading system running 24/7 with low-latency execution speeds, reducing delays that could lead to slippage.

Good news? If you’re trading with Switch Markets, you can qualify for a free VPS, ensuring your trades execute as fast as possible without interruptions. Best of all, you can also test your algo trading strategies on a demonstration account before you trade in live markets.

Final Thoughts - Why Choosing the Right Broker Matters

In sum, slippage is a part of trading, but how much it affects you depends on your strategy, execution, and broker choice.

To reduce slippage:

Now that you know how to manage slippage, it’s time to take control of your execution and trade smarter.

FAQs

By now, you’ve got a solid understanding of price slippage—what it is, why it happens, and how to minimize it. But let’s address some common questions traders still have about slippage to clear up any remaining confusion.

1. Can slippage ever work in my favor?

Yes! This is called positive slippage—when your order gets filled at a better price than expected.

For example, if you place a buy order at $100, but the price drops just before execution, you get filled at $99.80. That $0.20 difference is positive slippage, and it means you entered the trade at a discount.

2. Which types of orders help reduce slippage?

If you want more control over your entry and exit prices, limit orders are your best friend. Use them whenever possible.

3. Does slippage affect all assets equally?

No. Some markets experience more slippage than others. High liquidity pairs like EUR/USD tend to have less slippage, while exotic pairs can see more. For stocks, large-cap stocks usually have tight spreads and minimal slippage, but low-volume stocks can be a different story.

As to cryptocurrencies, because crypto markets can be volatile and less liquid, slippage can be a big problem, especially for large orders.

4. Why does slippage get worse during news events?

News events create a spike in volatility and widen spreads, making it harder for brokers to execute orders at the expected price.

If you trade right before or after major news releases (like NFP, CPI, or interest rate decisions), expect slippage to be much higher than usual.

Pro tip: If you don’t want to deal with wild price jumps, avoid trading during high-impact news periods.

5. Can my broker manipulate slippage?

A good broker executes trades fairly and transparently, but some brokers take advantage of slippage to increase their profits. Watch out for brokers that consistently slip orders in their favor, widen spreads excessively during normal market conditions, and delay executions, causing unnecessary slippage.

The best way to avoid shady practices? Trade with a regulated broker like Switch Markets, where you get fast, fair execution with minimal slippage, tight spreads, no unnecessary markups, and direct market access for better order fills.

If your broker seems to be “slipping” a little too often, it might be time to switch.