Tracking your day trades is crucial for your success as a trader. Not only does it help you stay organized—especially during tax season—but it can also significantly enhance your performance.

In this guide, you’ll learn why trade tracking is essential, the key metrics to monitor, and how to track your trades with Switch Markets.

Why Is It Important to Track Your Trades?

Tracking trades is not just a mundane task; it’s the cornerstone of a successful trading career. Reviewing your trading performance and identifying areas for improvement hones your skills over time. Think of it as a feedback loop – each trade you record provides invaluable insights that can help you fine-tune your trading strategy and make better trading decisions.

This is the reason why many prop trading firms insist that their prop traders track all of their trading performance and periodically analyze their records. Keeping a detailed record of your past trades allows you to analyze your trading style and adjust your strategies based on successful outcomes. This historical data acts as a mirror, reflecting your past performance and helping you understand what worked and what didn’t. It’s like having a personal coach who constantly provides you with actionable feedback.

By analyzing your trades, you can learn at what hours you are most effective, on which instruments you have the highest success rate, and what the best position size or lot size for you is.

In sum, recognizing profitable setups and avoiding losing trades becomes much easier when you have a comprehensive trading journal to refer to. Over time, this practice fosters discipline and increases your chances of becoming a profitable trader.

“The goal of a successful trader is to make the best trades. Money is secondary.” – Alexander Elder.

Tracking Your Trading Performance with Switch Markets in 5 Steps

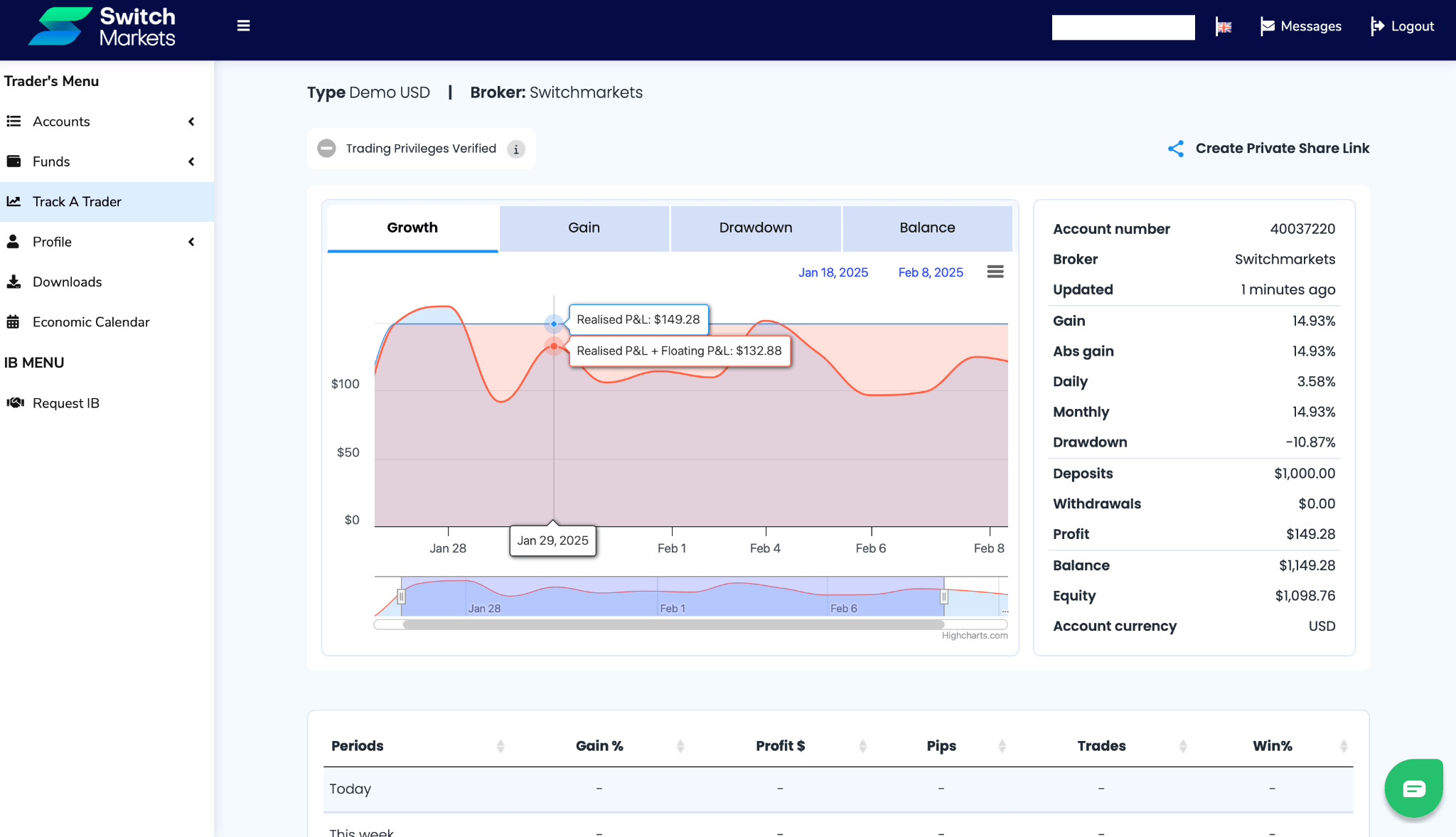

Tracking your trading performance can be quite a daunting task if you do not have a built-in application that tracks all of your trades and measures your performance. For that reason, we have developed Track A Trader, a powerful application that assists you in getting all the necessary data regarding your trading performance.

With Switch Markets, you get free access to Track A Trader, and you can easily connect your MetaTrader 4/5 account in order to track your trades and get full reports.

To learn how to track your trades with Switch Markets, you can watch the video below or go through our step-by-step guide below:

Here’s how to connect your Switch Markets trading account to Track A Trader:

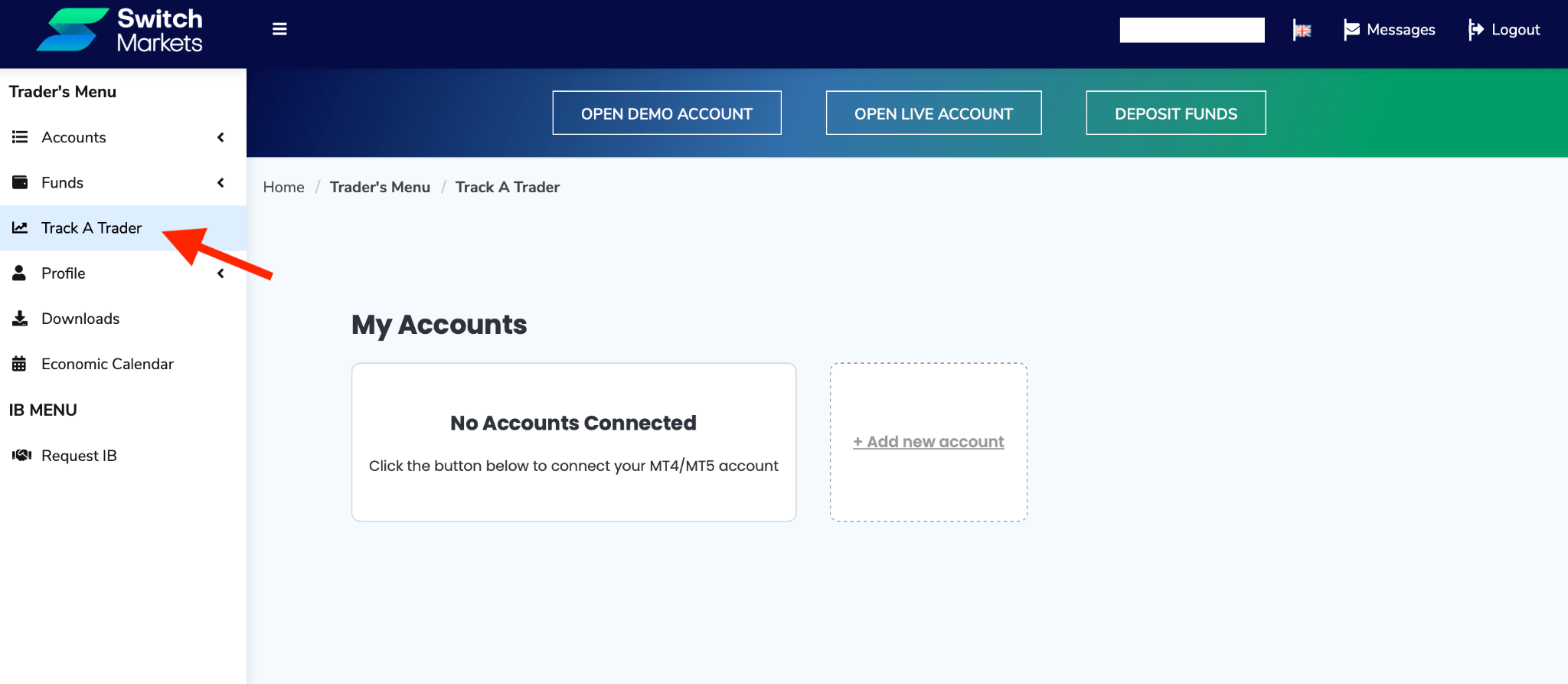

1. First, log in to your client terminal and navigate to Track A Trader on the left-side menu.

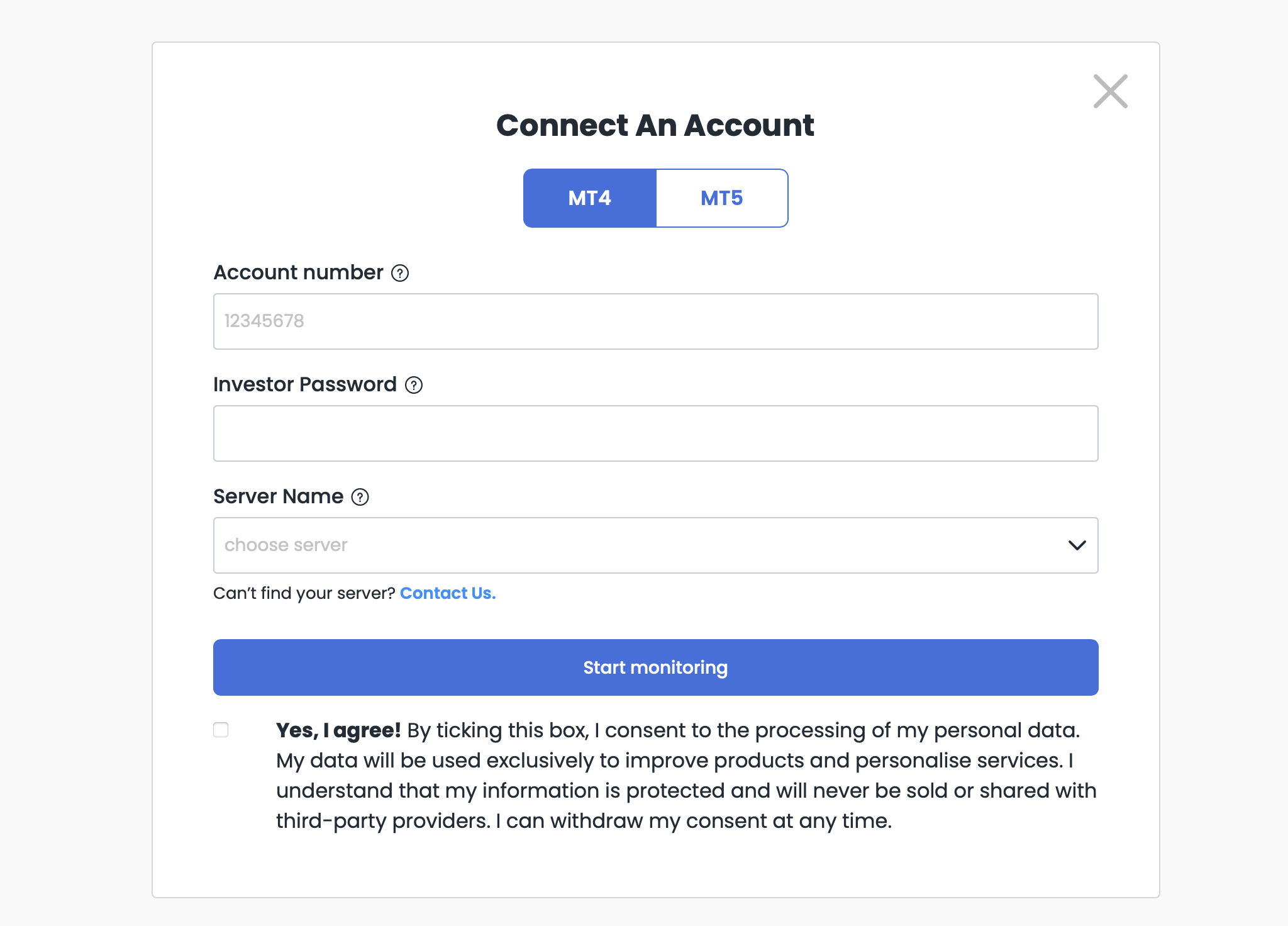

2. Next, you need to connect Track A Trader to your MT4/5 account. Simply enter your account details and choose the correct server. To get all your account details, navigate to account overview.

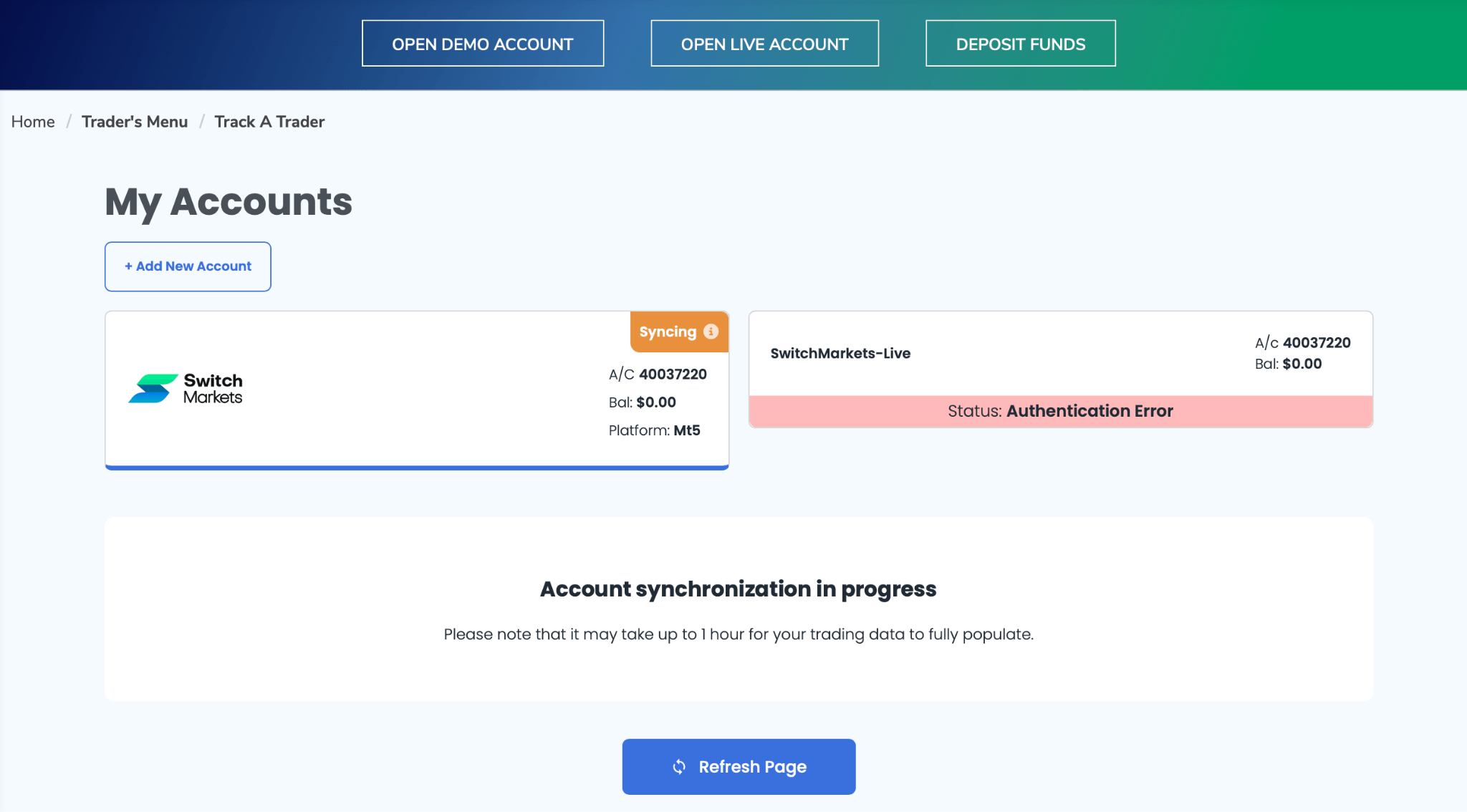

3. Once you have entered your account details, you’ll be transferred to the Track A Trader page. You should note, however, that it takes up to 1 hour for the system to synchronize your trading account to Track A Trader.

4. After your account has been connected to your trading platform, you can view the data directly on the Switch Markets client terminal as well as on the Track A Trader application.

5. Analyze your trades and make adjustments based on your performance.

Essential Metrics to Track

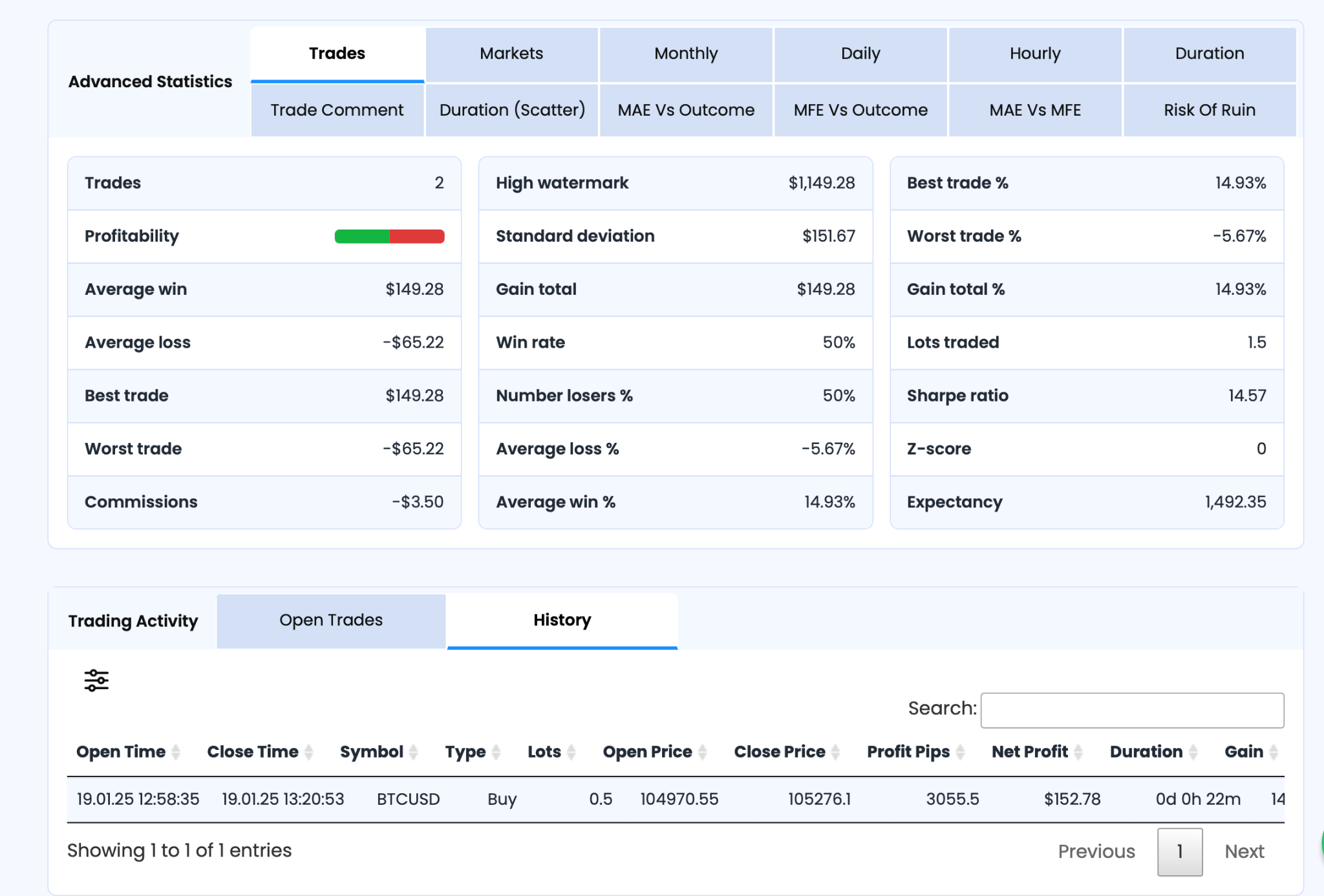

In order to effectively evaluate your trading performance, you must monitor and analyze specific metrics. Key data points include:

- Win rate

- Total P&L

- Risk-reward ratio

- The most successfully traded instrument

- Best trading hour of the day

- Commissions

- Trading activity

- Return on investment

- Risk percentage

Tracking these important metrics offers insights into trading behavior and informs strategy adjustments.

Any metric here can be crucial to your future success. You should not only analyze your profit or loss, your win rate, or ROI but also take into consideration key metrics such as the commissions you paid for the chosen period. If you notice that the commissions you paid are too high, you might want to consider switching to another account type (check our guide about ECN vs Standard account).

Keep in mind that in our tracking application, you get access to valuable data that is often not available on other tracking platforms. These detailed reports include:

- The markets you traded,

- The average win and average loss

- Best and worst trade,

- Losing and winning trades,

- The number of lots traded

- Trades entry and exit price

- Trade size

- Duration of trades

How to Analyze Your Trades?

So, how should you analyze your trade performance? Clearly, the way you analyze your trading performance should match your trading styles and the type of trader you are. Remember, not all traders are equal, and analyzing your trades can primarily help you identify your strengths and weaknesses.

As such, try to analyze key metrics in your trade activity - your best hours of the day and the instruments you trade profitably. How many trades do you take each day/week/month? Is your average win above or below your average loss? How many commissions did you pay? Does your trading strategy work?

All of these can help you evolve and, eventually, develop a successful trading strategy. At the end of the day, it’s you and the data, and you are the only one who knows how your trading performance and trading skills can be improved. To achieve that, you must analyze the data, set trading rules, and ensure you have the necessary trading discipline to follow the new structure.

To be a good trader, you must always adapt and find out what works best for you. And this can be done by tracking and measuring your trade performance.

Open a Live Account with Switch Markets