Dynamic leverage is a flexible system that adjusts your trading leverage based on specific criteria like trading volume, account equity, or market volatility.

Unlike fixed leverage, where the leverage ratio remains constant regardless of market conditions or account performance, dynamic leverage adapts in real-time to align with the ever-changing nature of the financial markets. Chances are that you’re already wanting to know more about this type of leverage, so let’s get right to it.

What Makes Dynamic Leverage Different?

To truly appreciate dynamic leverage, let’s first compare it to its more traditional counterpart: fixed leverage.

Fixed leverage provides a static multiplier to amplify your trading positions. For instance, if your broker offers a 1:100 fixed leverage ratio, this means that for every $1 of your capital, you can trade positions worth $100. While this sounds straightforward and predictable, it comes with a significant downside—it doesn’t account for shifts in market volatility or your account’s equity changes.

This rigidity can either magnify your gains or exacerbate your losses, often leaving traders exposed to higher risks than they realize.

Dynamic leverage, on the other hand, tailors your leverage ratio to specific parameters. For example:

- Trading Volume: As your trading volume increases, the system might reduce your leverage to mitigate risk. Conversely, for smaller trades, it might offer higher leverage to maximize potential returns.

- Trading Capital (Account Equity): If your account equity grows, the leverage might scale down to encourage more conservative trading. Alternatively, during lower equity phases, it could adjust to allow for more flexibility in trade sizes.

- Market Volatility: In highly volatile market conditions, dynamic leverage can automatically lower your exposure to protect against sudden market price swings. Conversely, in stable markets, it may increase leverage to optimize your opportunities.

In short, this adaptability ensures that you’re trading with a level of leverage that aligns with your current circumstances, offering a layer of protection and optimizing your strategy for various scenarios.

Why Should You Care?

Using a system that evolves with your trading activity and the market’s behavior can help you manage risk more effectively and potentially enhance your long-term profitability.

In the upcoming sections, we’ll go a little deeper into how dynamic leverage works, its benefits, and the scenarios where it truly shines. For now, just know that this isn’t just another buzzword—it’s a game-changer in the art and science of trading.

The adaptability of dynamic leverage ensures that you’re trading with a level of leverage ratio that aligns with your current circumstances, offering a layer of protection and optimizing your strategy for various scenarios.

How Does Dynamic Leverage Work?

Dynamic leverage works seamlessly in the background to ensure traders have the appropriate leverage for their positions, helping them balance potential rewards with risks. Let’s explore how it functions in detail with a practical example.

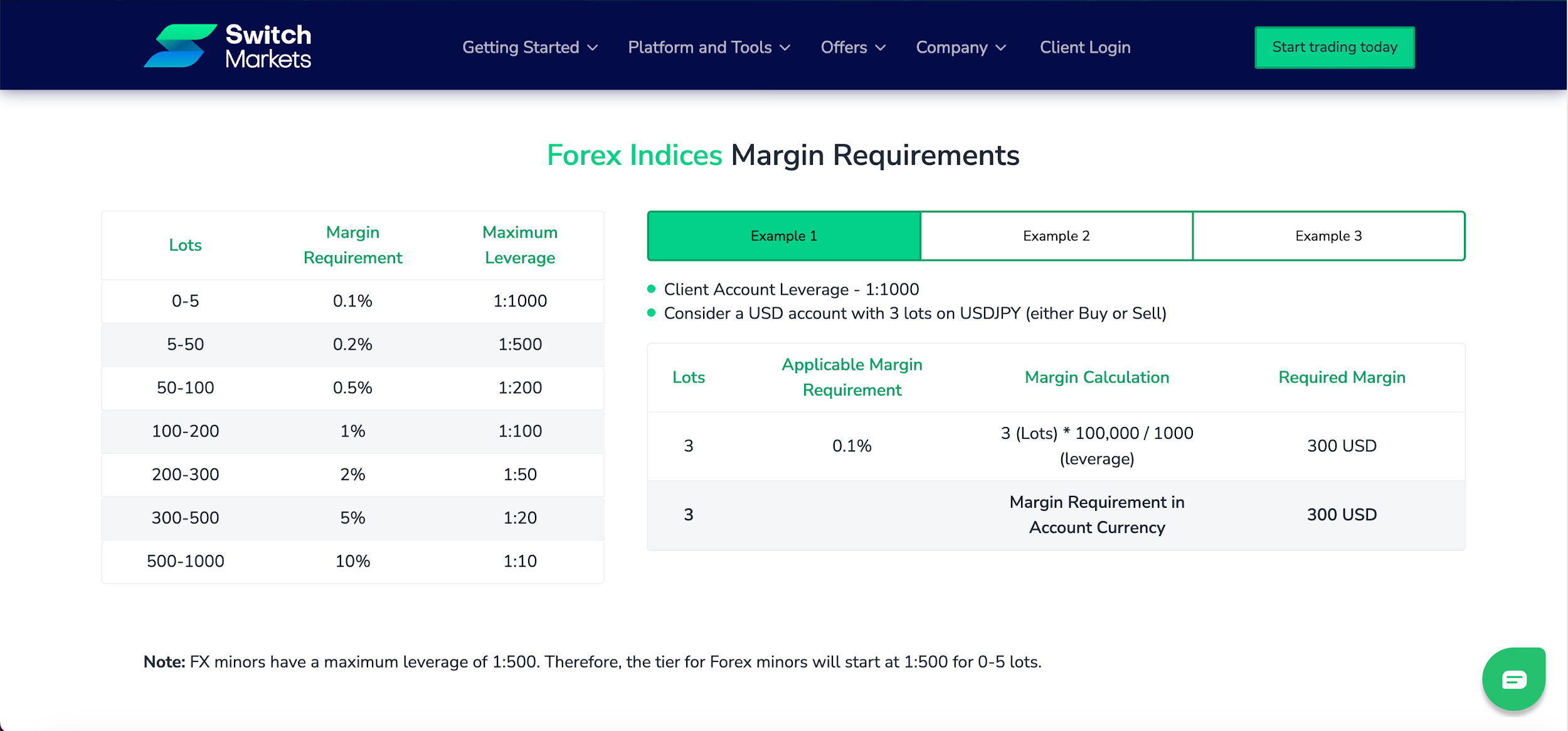

As you can see in the image below, these are the margin requirements clients can get on Switch Markets.

With the above in mind, now imagine a trader with $5,000 in the account decides to open (buy or sell) a 3-lot position on USD/JPY (a major forex pair). According to Switch Markets' dynamic leverage system, forex majors can have a leverage of up to 1:1000 for lot sizes between 0-5 lots. Now, here’s how the system would calculate the margin requirement:

- Applicable Leverage: The trade falls under the 0-5 lots category, which qualifies for a maximum leverage of 1:1000.

- Margin Requirement: Margin is calculated as the trade size (in units) divided by the leverage.

For 3 lots:

3×100,0003 times 100,0003×100,000 units / 1,000 leverage = 300 USD margin required.

This calculation shows that for a 3-lot position, the trader would need $300 in margin at 1:1000 leverage, leaving a significant portion of their account equity available for other trades or as a buffer against market fluctuations. This can help traders avoid a margin call, which is a demand by the broker to close the position or deposit more funds to cover losses.

Adjusting for Larger Lot Sizes

Another key benefit of the dynamic leverage tool is that it also adjusts traders' leverage for larger lot sizes. If the trader decides to increase the trade size beyond 5 lots, the dynamic leverage system will automatically adjust the leverage as follows:

- For 5-50 lots, the leverage reduces to 1:500.

- For example, a 10-lot position (worth $1,000,000) at 1:500 leverage would require:

10×100,00010 times 100,00010×100,000 units / 500 = $2,000 margin.

As the lot size increases, the required margin rises proportionally, reducing the risk associated with bigger positions.

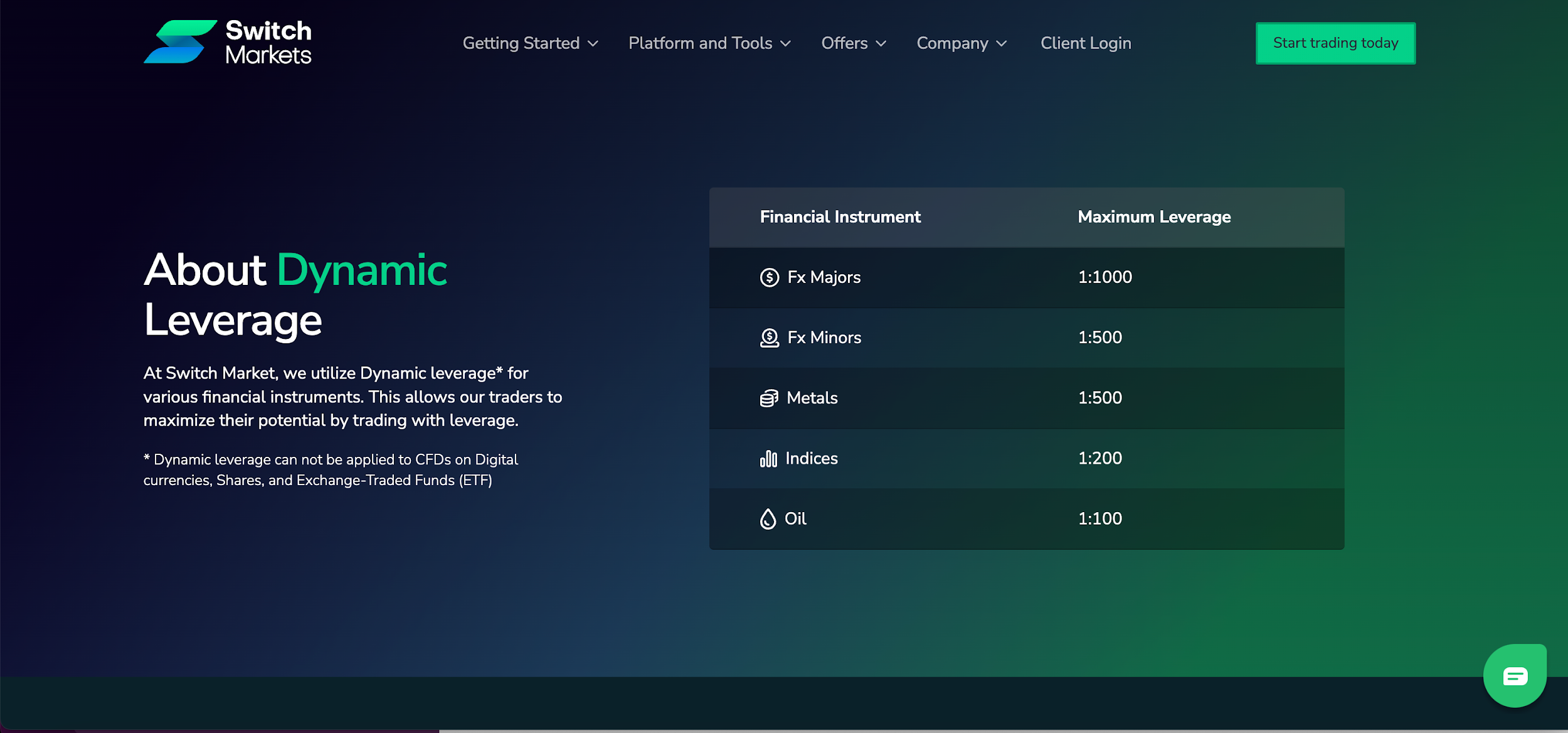

Switch Markets applies dynamic leverage tiers across multiple asset classes to offer flexibility and risk management. For instance, traders can access leverage of up to 1:1000 for forex majors, up to 1:500 for metals, and up to 1:200 for indices.

But the good news is that the Switch Markets system automatically adapts the leverage ratio based on the trade and market conditions, allowing traders to focus on strategy rather than recalculating margin requirements manually.

Advantages of Using Dynamic Leverage with Switch Markets

Dynamic leverage is a powerful feature that adapts to your trading needs, offering flexibility and control. Switch Markets integrates this system to enhance your trading experience.

Let's explore how dynamic leverage can benefit you.

Maximizing Potential

With dynamic leverage, you can amplify your trading potential, especially when dealing with major forex pairs.

Switch Markets offers leverage up to 1:1000 for these instruments, allowing you to control larger positions with a relatively small margin. This means that even with a modest account balance, you can engage in substantial trades, potentially increasing your returns.

Enhanced Risk Management

Dynamic leverage systems automatically adjust leverage based on trade size, account equity, and market conditions. This helps protect traders from over-leveraging and ensures that risk exposure aligns with the size of the position.

For example:

- For smaller trades, higher leverage is applied to optimize capital usage.

- For larger trades or during periods of increased market volatility, leverage is reduced to mitigate risk.

This adaptability provides a built-in safeguard, encouraging disciplined trading practices while allowing traders to remain active in various market conditions.

Understanding the risks associated with leveraged trading, Switch Markets also provides several tools to help you manage your positions effectively:

- Risk Management EA: Switch Markets provides Expert Advisor (EA) tools designed to calculate the exact lot size based on your desired risk-reward ratio, assisting you in making informed decisions directly within the trading platform.

- Trade Tracking Application: Switch Markets' traders can also access Track A Trader, a free application in their client terminal that helps them track and analyze their trading performance.

- Economic Calendar: Stay informed about upcoming economic events that could impact market volatility, enabling you to adjust your trading strategies accordingly.

These resources can also be integrated into the trading platforms, ensuring you have the necessary information at your fingertips to manage risks effectively.

Flexibility Across Instruments

One of the biggest advantages of dynamic leverage is its versatility. Brokers offering this feature, like Switch Markets, apply different leverage levels based on the type of instrument. For example:

- Major forex pairs: Up to 1:1000.

- Metals: Up to 1:500.

- Indices: Up to 1:200.

- Oil: Up to 1:100.

Efficient Use of Capital

Dynamic leverage optimizes capital allocation by minimizing margin requirements for smaller trades. For example, opening a 3-lot position on EUR/USD at 1:1000 leverage might only require $300 in margin, leaving the remaining account equity free for additional trades or as a safety buffer. This ensures that traders can effectively manage multiple positions without overextending their resources.

Switch Markets' implementation of dynamic leverage, combined with its suite of risk management tools, empowers you to navigate the financial markets with increased confidence and precision. Open a Switch Markets account today, and get access to dynamic leverage.